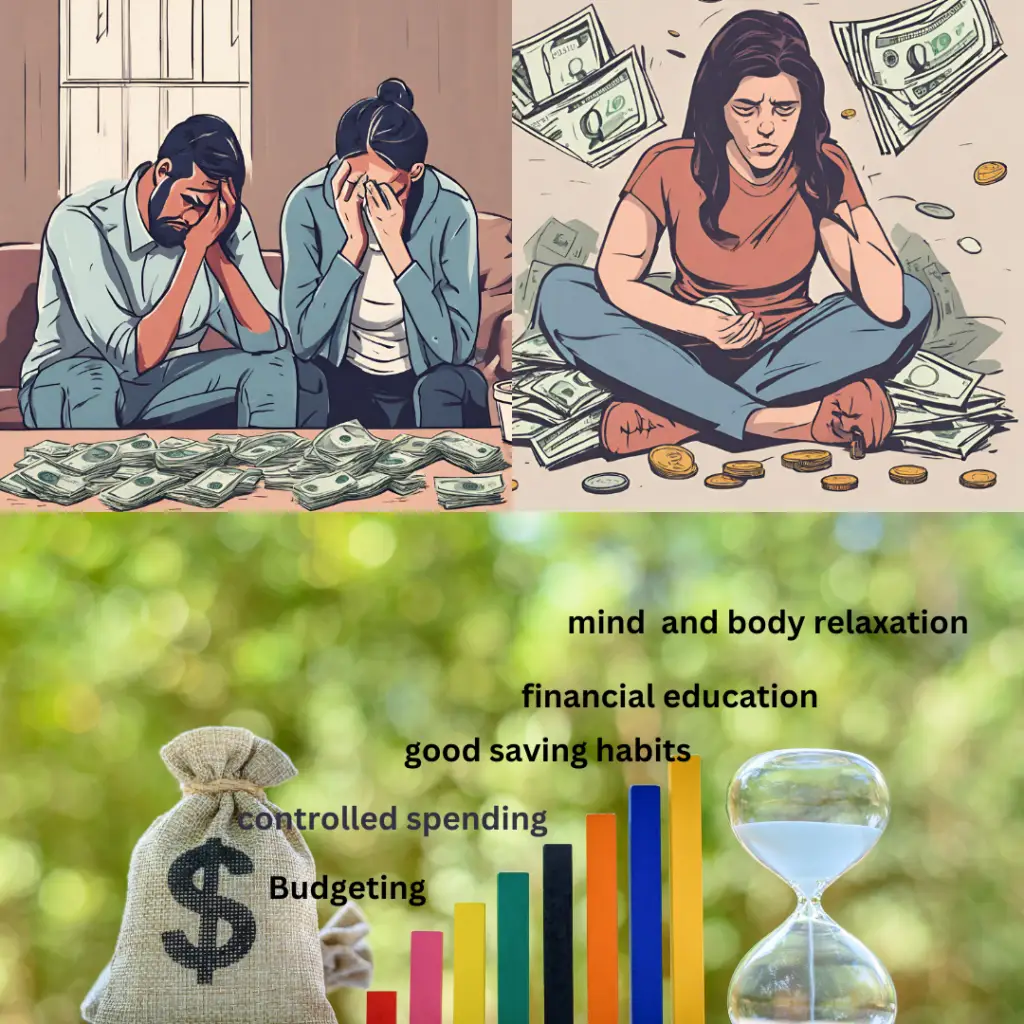

Dealing with financial stress and anxiety is challenging and can be pretty tricky to cope with. Financial stress and anxiety can significantly impact our overall quality of life, interpersonal relationships, and well-being. This comprehensive discussion aims to explore the psychological complexities of managing finances, examine the primary sources of financial stress and anxiety, provide practical tips for dealing with these challenges, and offer strategies for navigating this intricate landscape.

There are many aspects of life where financial stress and anxiety permeate, impacting relationships, general happiness, and mental and physical health. To address these issues, we must understand the underlying reasons and how they manifest in our cognitive and behavioral domains.

Table of Contents

The Psychological Effects of Anxiety and Financial Stress

Fear of the Unknown

Financial anxiety is caused due to the fear of undetermined future events. The anxiety that arises from being unable to predict or control future financial results can increase stress levels, regardless of the source of concern—job security, market swings, or unplanned expenses.

For example, Jill has lost her job lately due to organizational downsizing. Though she is actively looking for work, she worries about how long her savings will last and whether she can pay her bills until she finds another job.

Historical Traumas

Unfavorable financial situations in the past may leave deep emotional scars that exacerbate persistent worry. Traumatic occurrences involving bankruptcy, property foreclosure, or other financial troubles often sow deep-seated anxieties and uncertainties around finances.

For example, consider the family that raised Ken, whose money was always tight. Watching his parents fight for money all the time and struggle to pay their bills left an enduring impression on him. As an adult, Ken struggles to trust financial institutions and constantly worries about repeating past experiences.

Social Pressures

In today’s hyper-connected world, succumbing to the pull of comparison, especially regarding material success, is easy. Social media sites frequently provide well-manicured images of luxury, creating unattainable standards and engendering emotions of inferiority.

For example, Kimmy is aware of her financial limitations but still feels pressured to keep up with her friends’ opulent lifestyles. To maintain the appearance of wealth, she regularly indulges in opulent dining excursions and fashionable clothing purchases.

Incomplete Understanding of Financial Literacy:

Inadequate knowledge of personal finance hampered well-informed financial decisions, increasing stress and worry. Without a solid understanding of fundamental ideas like investing, debt management, and budgeting, people could feel helpless and unable to improve their financial situations.

For example, Dan had a large student loan debt upon graduation but needed to be financially savvy enough to create a budget or handle his money well. As a result, he struggled with money and continued to worry about his mounting debt.

Methods for dealing with financial stress and anxiety

Now, discussing the leading causes of financial tension and anxiety, let’s look at practical methods for overcoming these feelings and promoting economic well-being.

Finding the Core Causes:

Take time to reflect on the factors that lead to money-related worry and tension. Understanding the root causes of problems—financial, lifestyle, or retirement—is the first step towards finding solutions.

For example, Jill’s reflections reveal that her fear of running out of money results from growing up in a family with erratic finances. She can deal with this worry more skillfully if she acknowledges its underlying cause.

Budget Planning:

Creating a budget allows you to keep a close eye on your earnings and outlays, providing a clear picture of your financial trends. Start by drawing a line between fixed costs like rent and utilities and discretionary costs like eating out so that you can see which areas can be cut.

For example, Ken uses a budgeting tool to check his expenses and finds that he needs to spend more on entertainment and eating out. By reducing these unnecessary expenses, he directs funds toward his goal of saving.

Establishing an Emergency Fund:

A financial safety net helps people feel at ease during uncertain times. Aim to build enough cash in a money market fund or high-yield savings account to cover three to six months’ living costs.

For example, Kimmy progressively increases her emergency fund by setting up an automated monthly transfer from her checking to her savings account. This guarantee of a safety nett eases her concerns about unanticipated costs.

Spending with awareness:

Before making purchases, consider how they fit your priorities and values. Make a distinction between needs and wants. Creating a waiting time for non-essential purchases helps avoid impulsive purchases and consumer regret.

For example, Dan follows the “30-day rule,” which is to forgo non-essential purchases for thirty days. This develops responsible spending habits by helping him separate urgent requirements from transient impulses.

If you’re experiencing anxiety or tension related to money, don’t be afraid to ask for help. External advice and support can be helpful when confiding in a family member, financial expert, or trusted confidant.

Seeking Support:

For example, Jill confides in her trusted friend about her money worries, and the friend suggests a qualified financial advisor. Jill has confidence in her financial future with the advisor’s help, which eases her financial concerns and further allows her to maintain a healthy lifestyle.

Focus on Controllable

Although outside circumstances might affect financial situations, focusing on things under your control, such as your spending patterns and savings rates, encourages proactive actions and lessens feelings of powerlessness.

For example, Ken shifts his attention from worrying about his job security to increasing his emergency fund and paying off his debt. He reduces uncertainty about the future and fosters a sense of empowerment by taking concrete actions toward financial improvement.

Practice Self-Compassion

Be compassionate to yourself, especially when facing hardship. Recognise that achieving financial success is a road fraught with obstacles. Honor small victories and avoid drawing unfavorable comparisons.

For example, Kimmy accepts that every person’s financial journey is different and views her mistakes in the past as teaching moments. Rather than lamenting previous financial mistakes, she encourages a positive, forward-thinking outlook.

Developing Good Coping Strategies

Take part in stress-relieving pursuits that don’t cost money, such as physical activity, meditation, or spending time with close friends and family. These activities reduce anxiety and promote overall health.

For example, Dan takes his daily walk in the park after work to relax and clear his head. Engaging in physical activity not only lowers stress levels but also improves concentration and productivity.

Helpful resources for dealing with financial stress

Alongside the above-listed tactics, there is a tonne of resources available to help people learn more effective coping mechanisms for financial stress and anxiety.

Financial Literacy Resources: For in-depth tutorials, articles, and tools covering various personal finance topics, check out websites such as Investopedia, The Balance, and NerdWallet.

For example, Ken spends a lot of time reading through the “Personal Finance” area of Investopedia and learning in-depth information on investing, retirement planning, and budgeting. This instills trust in his financial sense.

Financial software: Use software for tracking finances, including Mint, YNAB (You Need a Budget), or Empower

Conclusion

To sum up, dealing with financial stress and anxiety requires a combination of self-awareness, realistic methods, and encouraging relationships. People can take back control of their finances and improve their overall well-being by understanding the psychological aspects of financial management, identifying the root causes of stress, and taking preventative action. It is crucial to understand that help is available to you at every step during this process, highlighting that you are not traveling alone and that plenty of resources support you.

Also read MASTERING FINANCIAL MANAGEMENT: 10 SMART WAYS TO BUDGET AND MANAGE YOUR MONEY